Financial Data

Loan Data

Customer Data

Transactional Data

Satellite & GIS Data

Credit Reference Bureau Data

Call Centre logs

Mobile Money Data

Customer Surveys

SMS logs

Financial Data

Loan Data

Customer Data

Transactional Data

Satellite & GIS Data

Credit Reference Bureau Data

Call Centre logs

Mobile Money Data

Customer Surveys

SMS logs

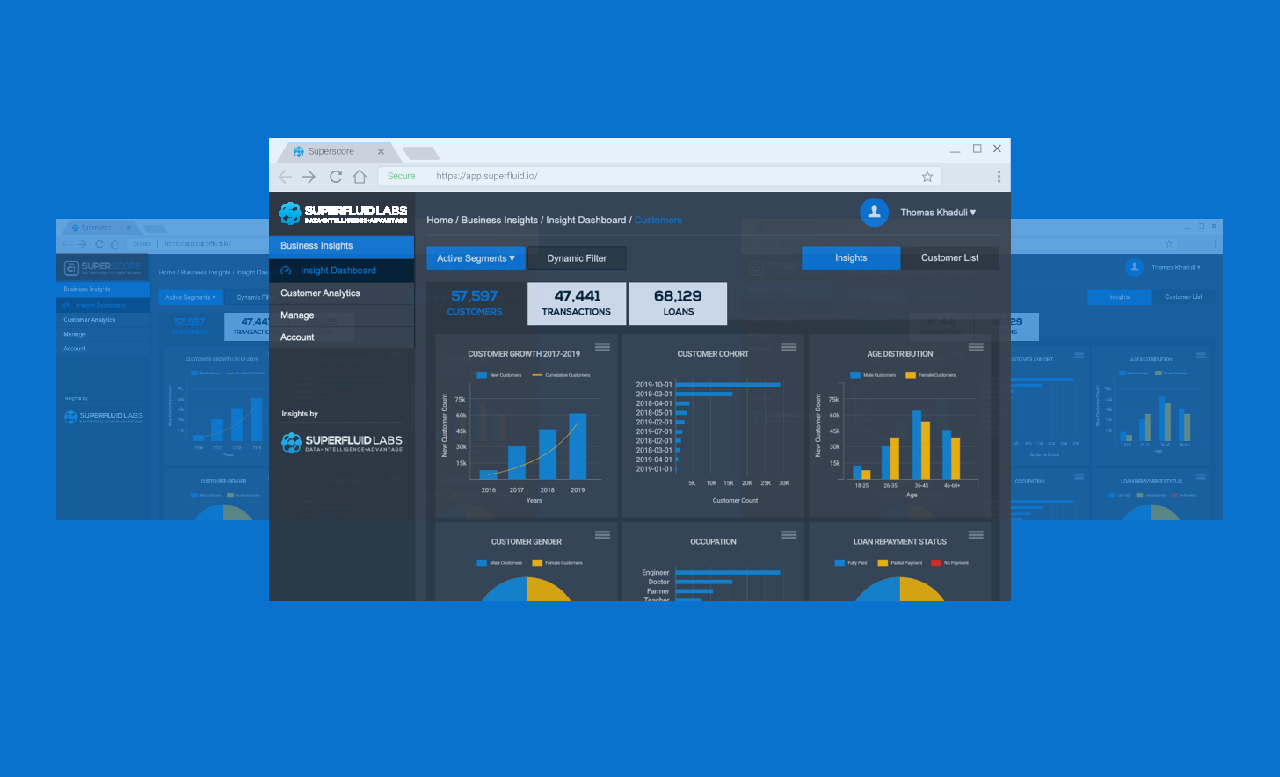

Our Digital Credit Scoring Models Help Reduce Losses And Increases Profit For Retail Lending Businesses

Segment and Understand Customers, Prevent Churn, Retain, Upsell and Cross-Sell to Valuable Customers

Personalize customer communication and engagement with data-driven intelligence for effective results

Business Intelligence

Customer Insights

Churn Risk Analysis

Precision Marketing

Customer 360 View

Customer Segmentation

Credit Risk Analysis

Cross-sell and up-sell

Customer Listings and Rankings

Most Profitable Customer Analysis

Data Aggregation

Data Preparation

Feature Engineering

Model Optimization

Explainable AI Models

Automated Machine Learning

Model Selection

Automated Model Deployment as API

Data Cleaning and Transformation

Accuracy and Speed in Decision making

Business Intelligence

Customer Insights

Churn Risk Analysis

Precision Marketing

Customer 360 View

Customer Segmentation

Credit Risk Analysis

Cross-sell and up-sell

Customer Listings and Rankings

Most Profitable Customer Analysis

Data Aggregation

Data Preparation

Feature Engineering

Model Optimization

Explainable AI Models

Automated Machine Learning

Model Selection

Automated Model Deployment as API

Data Cleaning and Transformation

Accuracy and Speed in Decision making

Financial Services

Clean Energy

Agriculture

Retail/Commerce

Tech Startups

Financial Services

Clean Energy

Agriculture

Retail/Commerce

Tech Startups

500+

Million Customer Records processed

9

Sustainable Development Goals

5+

multi-industry impact

10+

AFRICAN COUNTRIES SERVED BY OUR BUSINESS CUSTOMERS

4

Global Awards in four Years

Our partners are global, leading technology and services companies

We are excited to learn more about your interest in Superfluid Labs and discuss how we might be able to help with your data and analytics goals. Our team will be happy to do a deeper dive on our products to determine if it is a fit for your project.